rhode island sports betting tax rate

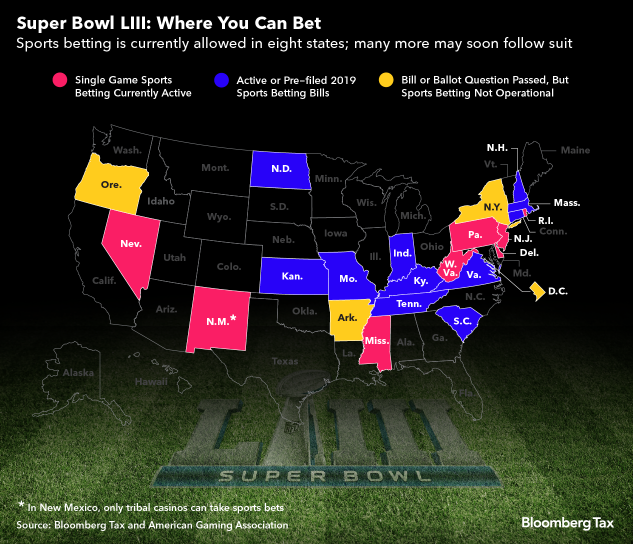

The performance of the sports betting sector in Rhode Island has been underwhelming to date. HB 8350 2018 South Dakota.

Rhode Island Sports Betting Is It Legal Get 5000 In Free Bets

This is part of a revenue sharing model Rhode Island have with Delaware where revenue is shared between state casinos and operators.

. That said individual results may vary. You will see this spelled out in your W2-G when tax time rolls around. There is no sure bet in sports betting policy especially in Rhode Island where exorbitant tax rates a government monopoly on legal betting and superfluous restrictions have delayed and hindered the market.

But the registration requirement removal bill has as good of odds as any piece of legislation. And so far its mission accomplished regarding tax revenue. Rhode Island Sports Betting Tax Rate.

Rhode Island has an oddly high gambling winnings state tax of 51 on all gambling winnings revenue. 31 rows Commonly sports betting operators have revenue known as hold of 5 percent of the handle. Nevada 675 New Jersey 975 in-person1425 online New Hampshire Not Yet Specified Pennsylvania 34 Rhode Island 51 Tennessee 20 West Virginia 10.

Put simply for every 100 in sports betting revenue Twin Rivers keeps 17 while Rhode Island grabs 51. No additional fee for sports wagering. State Sports Betting Tax Rate.

One of the core motivations for states to legalize sports betting was the potential tax revenue the activity would generate. Rhode Island Sports Betting Revenue. Rhode Island sportsbooks pay tax on a revenue sharing basis.

RI sports betting started in late 2018 after the state. There is effectively a 51 percent tax on gaming which blows Pennsylvanias much-maligned 36 percent tax rate out of the water. What is the tax rate for Rhode Island sports betting.

That makes New Yorks model a revenue share between the state and its nine sportsbooks Daniel Wallach an attorney and preeminent figure in the gaming and sports betting world said this week on The Favorites. If you receive cash from a sports betting facility you will receive a total that already has taxes taken out of it. Sports betting tax rates range from.

Facilities are required to withhold 24 of your earnings for federal withholding tax. Sports betting taxes are almost always levied as a percentage of the value of. Rhode Island has faced questions about its economic modeling for sports betting since it launched with a colossal 51 state tax ratethe highest in the nation.

During the first month of operations there was 13m worth of sports bets and the casinos made a profit of about 950000. 21 rows When PASPA was overturned in 2018 states began legalizing sports betting and introducing. So far sports betting has proven to be successful if.

The Rhode Island Lottery regulates all sports betting in the state. Sportsbook RI - Rhode Island Registration. As with some other states the Rhode Island betting tax rate varies depending on a persons overall income over.

A 51 tax rate on profits significantly higher than the 13 rate on mobile bets in New Jersey or the 10 in Colorado both sportsbook-friendly states. While it does not have this designation that essentially means Rhode Island set a 51 percent effective tax rate on sports betting revenue. As with other gaming tax revenue 40 of proceeds are dedicated to the tourism promotion fund10 is paid to Lawrence county.

The StateCity Wagering Tax totals 19 percent of the three casinos net win. But with Rhode Island sports betting tax rates for betting operators are unusually high compared to other states as they have to pay 51 of their revenues in tax. Annual 2000 fee for sports wagering services providers.

This leaves 17 for the states sportsbooks. The entire State Wagering Tax 81 percent of the casinos net win is deposited into the School Aid Fund for statewide K-12 classroom education. Remote registration As of July 28 2020 Rhode Island bettors can complete the registration process from anywhere in the state.

Rhode Island Governor Gina Raimondo signed a 96 billion budget for fiscal 2019 on Friday that legalizes sports betting and gives the state 51 percent of. Rhode Island also became the state with the highest tax rate according to the law sports betting profits will be split between the state the states gaming operator and the casinos as follows. 28 rows Rhode Island sports betting.

The state receives 51 of all sports betting revenue while software supplier IGT collects 32. It has the highest tax rate for sports betting revenues of anywhere in the country at 51. The exceptions to the rule are Delaware New Hampshire and Rhode Island which all have rates around 50 percent and Pennsylvania with a 34 percent rate.

51 percent 32 percent 17 percent.

Rhode Island Sports Betting Is It Legal Get 5000 In Free Bets

U S Top 5 Earners For Sports Betting Tax Revenue By State In 2020 Gaming And Media

Rhode Island Sports Betting Guide 2022 Best Ri Sportsbooks

Patriots Fans Flock To Rhode Island To Bet On The Super Bowl Boston Herald

Rhode Island Sports Betting 2022 Legal Ri Sports Betting

Rhode Island Sports Betting Is It Legal Best Ri Sportsbooks 2022

Rhode Island Sports Betting Is It Legal Get 5000 In Free Bets

Rhode Island Sports Betting Is It Legal Get 5000 In Free Bets

Rhode Island Sports Betting Is It Legal Get 5000 In Free Bets

What Other States Can Learn From Rhode Island As Sports Betting Expands In 2020

Will Sports Betting Provide Significant Tax Revenue For Education Infrastructure Masslive Com

Sports Betting S Rapid Expansion Faces More Tests In 2020 The Seattle Times

Rhode Island Sports Betting Market Books Record June Revenues

Rhode Island Sports Betting Is It Legal Get 5000 In Free Bets

Governor Signs Rhode Island Sports Betting Into Law

Sports Betting Revenue Not Delivering Forecasted Tax Benefit

Rhode Island Sports Betting Is It Legal Get 5000 In Free Bets

Rhode Island Sports Betting Guide 2022 Best Ri Sportsbooks

Super Bowl Gamblers Here S Where You Can Bet How You Ll Be Taxed